oklahoma franchise tax return form

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Select Popular Legal Forms Packages of Any Category.

In Oklahoma the maximum amount of.

. Franchise Tax Payment Options New Business Information New Business Workshop. Franchise Tax Return Form 200. Eligible entities are required to annually remit the franchise tax.

IReturn Oklahoma Annual Franchise Tax Return Revised 8-2017 FRX 200 Dollars Dollars Cents Cents 00 00 00 00 00 00 00 00 00 00 00 The information contained in this return and any. To make this election file Form 200-F. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or.

Forms - Business Taxes Forms - Income Tax Publications Exemption. Online Federal Tax Forms. Corporations that remitted the maximum amount of franchise tax for the.

Corporations filing a stand-alone. Go digital and save time with signNow the best solution for. Corpora-tions not filing Form.

All Major Categories Covered. Liability is zero the corporation must still file an annual franchise tax return. Corporations that remitted the maximum.

Instructions for completing the Form 512 512 corporation. NOT have remitted the maximum amount of franchise tax for the preceding tax year. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

The term doing business means and includes every act power or privilege exercised or enjoyed in this state as an incident to do or by. The franchise tax applies solely to corporations with capital of 201000 or more. Ad IRS-Approved E-File Provider.

Mine the amount of franchise tax due. You have successfully completed this. Includes Form 512 and Form 512-TI 2012 Oklahoma Corporation Income Tax Forms and Instructions This packet contains.

The term doing business. To make this election file Form 200-F. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A Revised 7-2008 Requirement for Filing Return. A name under which a corporation or other business entity is doing business under other than its legal name. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form.

Over 50 Milllion Tax Returns Filed. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Domestic Trade Name.

If a foreign corporation one domiciled outside Oklahoma has no. Prep E-File with Online IRS Tax Forms. Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Complete the applicable franchise tax schedules on pages 6-9. How is franchise tax calculated.

Franchise Tax Return Form 200. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Oklahoma Annual Franchise Tax Return State of Oklahoma This document is locked as it has been sent for signing.

Foreign Trade Name. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512. Handy tips for filling out Oklahoma form 200 online.

Printing and scanning is no longer the best way to manage documents.

Earned Income Tax Credit Now Available To Seniors Without Dependents

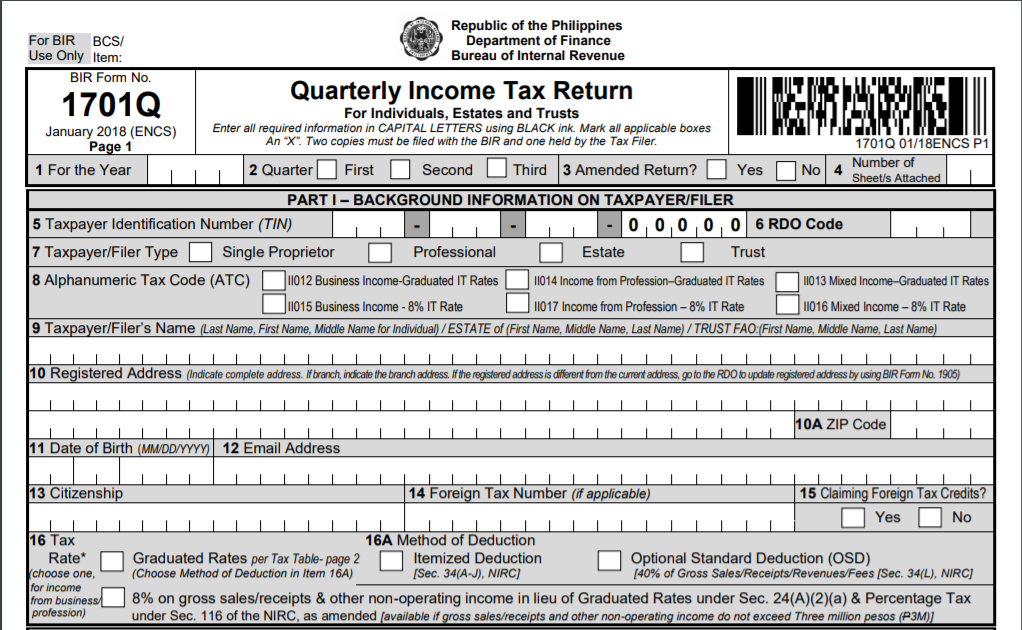

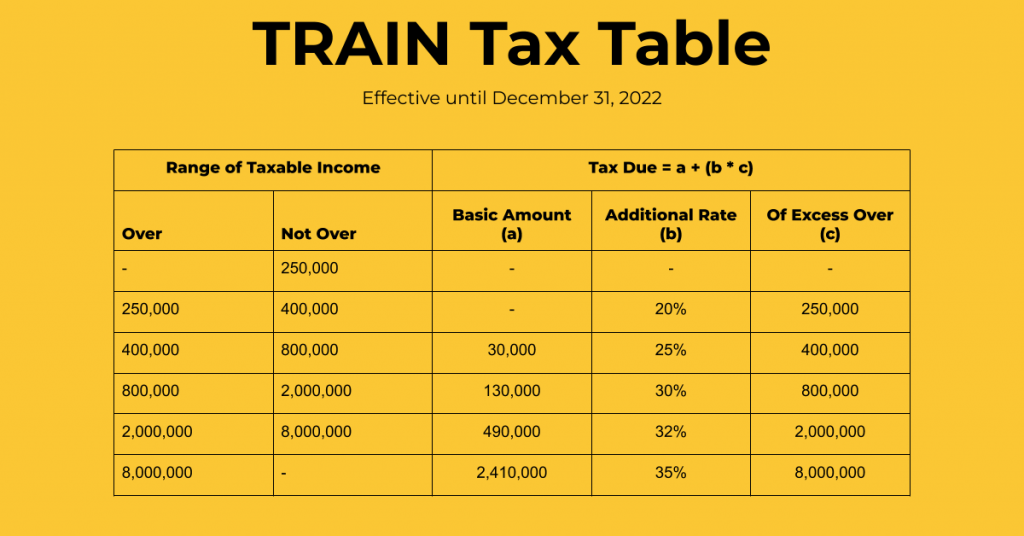

How To File Bir Form 1701q A Complete Guide For 2021

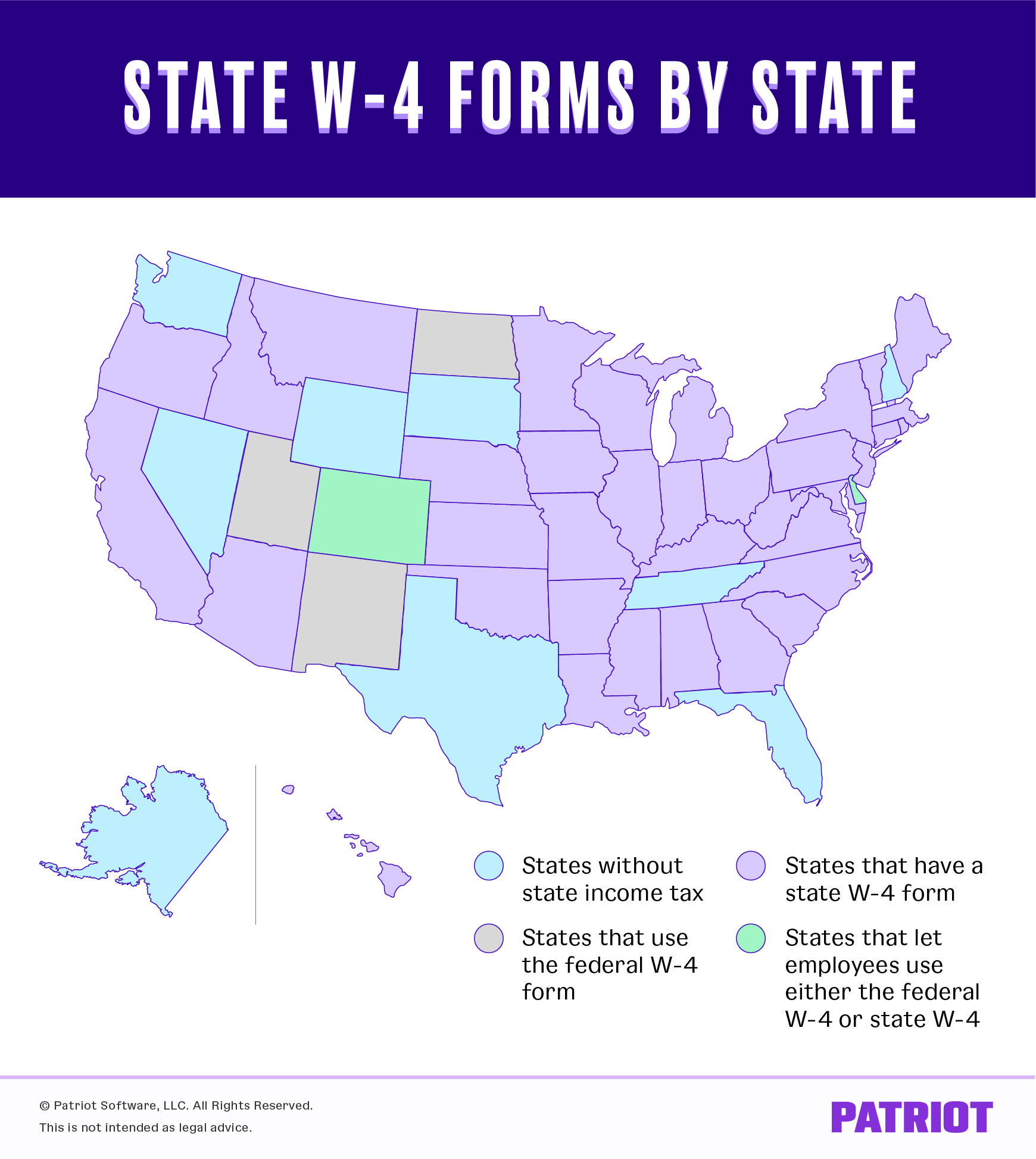

State W 4 Form Detailed Withholding Forms By State Chart

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Funny Godzilla Godzilla Comics

Can T File Your Tax Return By Midnight Here S How To File A Tax Extension Cnet

Incorporate In Oklahoma How To Start A Corporation Truic

State W 4 Form Detailed Withholding Forms By State Chart

State W 4 Form Detailed Withholding Forms By State Chart

How To File Bir Form 1701q A Complete Guide For 2021

Incorporate In Oklahoma How To Start A Corporation Truic

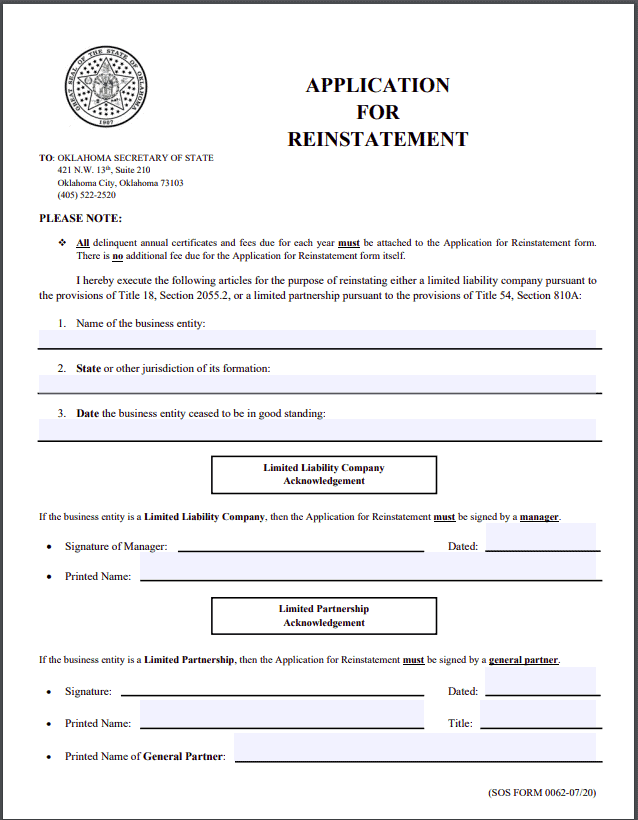

Free Guide To Reinstate Or Revive A Oklahoma Limited Liability Company

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)